Beginners

Forex

Market events

What is the NFP report?

Why is the Non-farm payroll important?

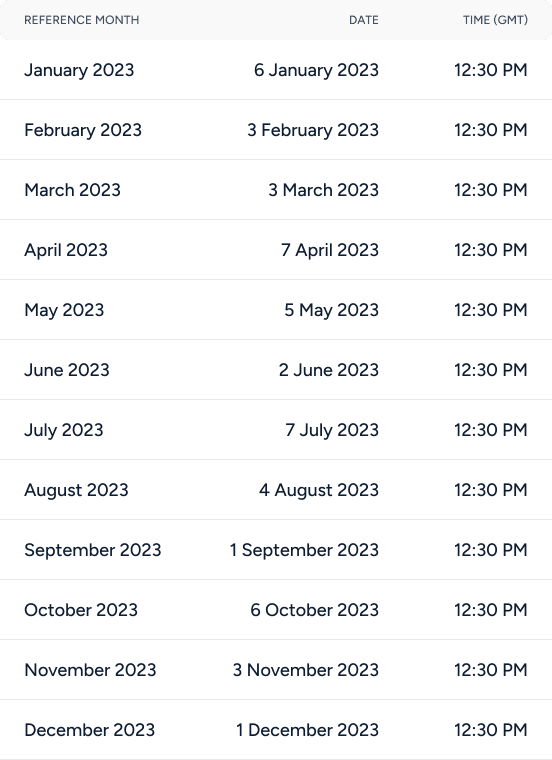

Non-farm payroll report calendar

The NFP is released typically every first Friday of the calendar month at 13.30pm (GMT), below you can see the dates for 2023.

How does the NFP affect the markets?

The NFP report is important to traders as it can be a cue to analyse how other factors will adapt, such as the Federal Reserve and other government agencies, to attempt to move the economy in a certain direction. It is just one factor of many that can act as a catalyst for volatility and market price changes.

The government will adapt policies to combat issues within the economy such as inflation or recession. If the NFP report indicates employment is dropping, it could indicate that the economy is declining. This, in turn, will prompt the Federal reserve to adjust interest rates to restore balance. If rates adjust, this will trickle down into the markets.

Trading on Non-farm payrolls

Firstly, monitor the report. The primary focus of the NFP report are the employment figures, mainly on jobs added or reduced. However, there are smaller components you can also watch out for when trading.

Take note of sector specific data

If the NFP report shows a decline in employment, traders will monitor which industries or sectors this decline is coming from. It could indicate the sector itself is struggling, which can have a knock-on effect to stocks and shares.

Don't just focus on figures, also focus on earnings

If average hourly earnings have dropped, but the employment figures are stagnant, this could also indicate a decline. It could also point to trouble where we could see the workforce output fall as employees could leave the workplace due to declining earnings. On the other hand, higher earnings could indicate wage inflation.